The paper highlights current trends in the use of social key performance indicators (KPIs) in Sustainability-Linked Finance (SLF), with a focus on the infrastructure and natural resources sectors.

In only a few years, sustainability-linked finance has introduced a new dimension into the universe of financial instruments available to companies and investors. The new dimension is this: SLF holds borrowers and issuers accountable for meeting stakeholders’ expectations of long-term societal value creation—and not just corporate profit.

SLF transactions can help companies deliver on their sustainability efforts in many aspects of environmental, social, and governance (ESG) performance. It holds particular promise in developing countries, where social and environmental challenges are vast.

Despite a slowdown in 2022, SLF volume has grown in recent years. As of June 2023, total global SLF issuances surpassed the $1.6 trillion mark, with the majority – about 85 percent – in sustainability-linked loans (SLL), and the remaining 15 percent in sustainability-linked bonds (SLB). At 52 percent, the majority of SLF issuances to date are concentrated in Europe and Central Asia. SLF issuances in low- and middle-income countries totalled about $113 billion as of June 2023, representing only 7 percent of the total.

Based on the available data, about 69 percent of total global issuances to date have corporate environmental KPIs – with carbon emissions-related KPIs the most common. The number of

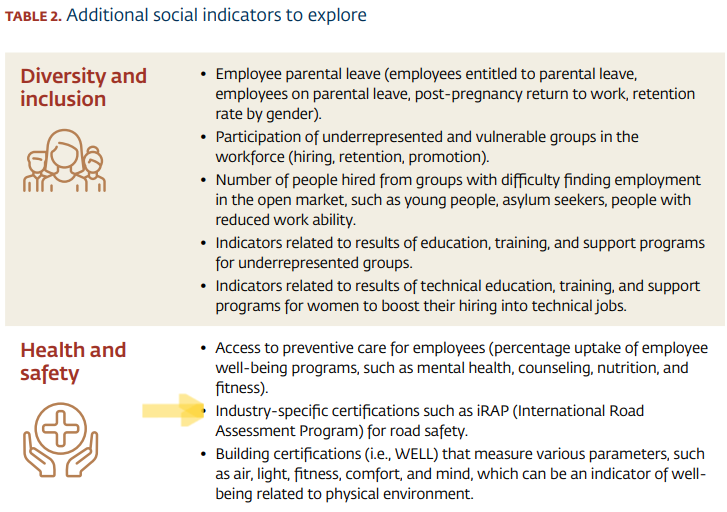

transactions using social KPIs lags, with about 21 percent of SLLs and SLBs including social and/or governance targets. Most of the transactions with social KPIs also include environmental metrics or environmentally friendly use of proceeds. Transactions to date that include social KPIs typically feature gender equality and worker safety metrics.

With a focus on development finance, this paper explores the current trends and future directions in integrating social metrics in SLF transactions. It also offers recommendations for advancing the use of social KPIs by SLF market participants.

Given the diversity of these sectors and evolving nature of SLF itself, this paper is not intended to offer a finite, comprehensive reference guide on the use of social KPIs in SLF transactions. Rather, it explores the current landscape, looks ahead at the social issues that might drive the next generation of KPIs, and offers insights around their implementation based on IFC’s own experiences to date.

There is a growing public embrace of “stakeholder capitalism,” in which companies are expected to not just optimize short-term profits for shareholders and do no harm, but to seek long-term value creation, by considering the needs of all their stakeholders, along with society as a whole.

The paper aims to stimulate discussion among market participants on opportunities and challenges in advancing the use of social KPIs in SLF to create more inclusive and sustainable growth.

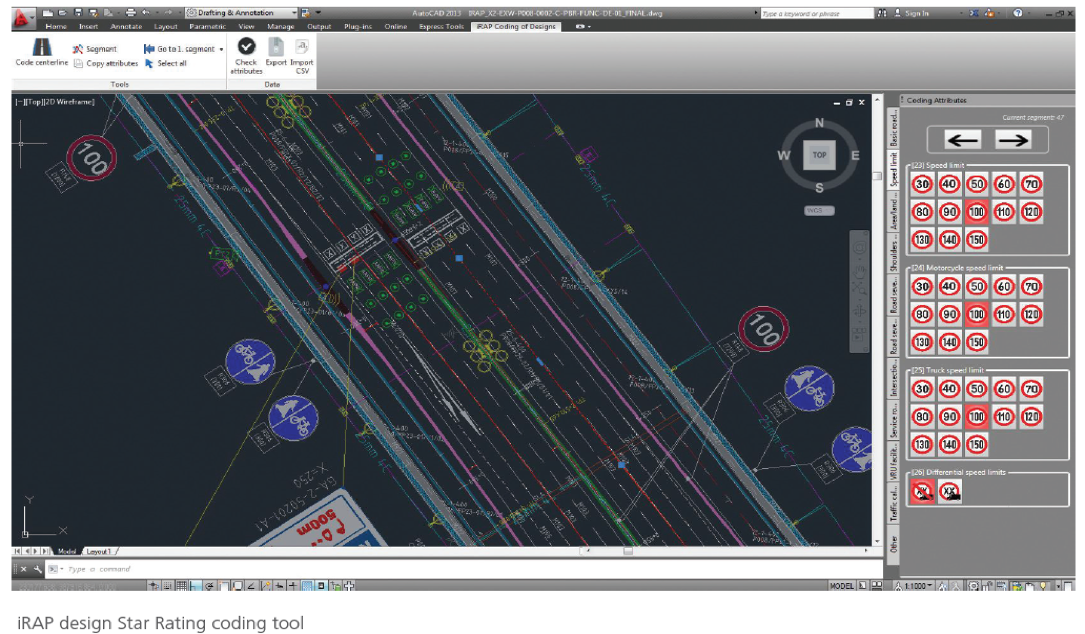

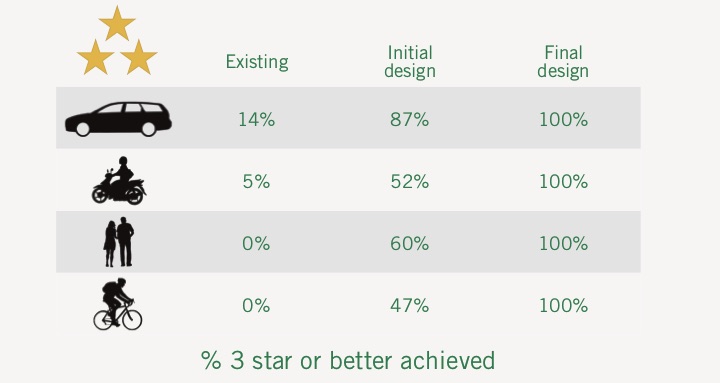

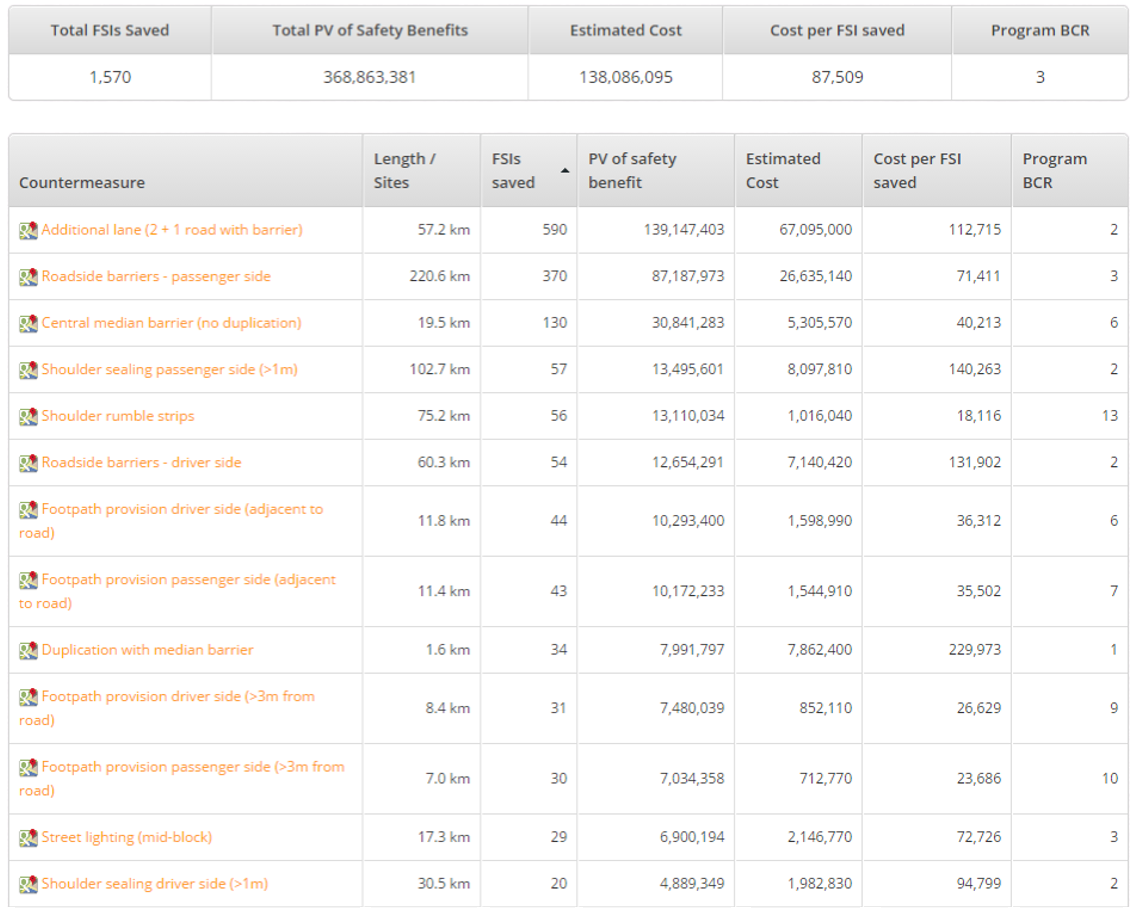

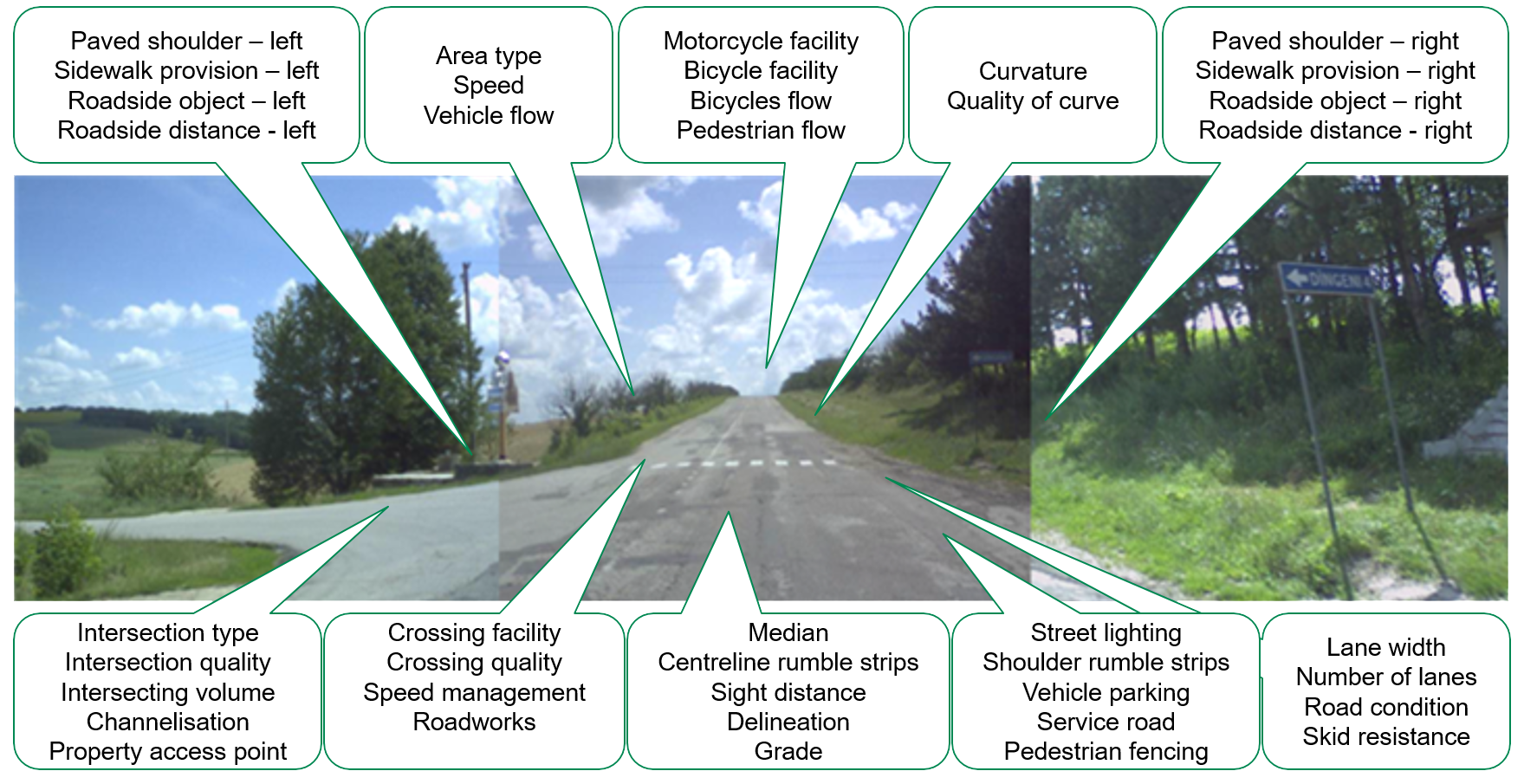

It recognises iRAP as an industry-specific social indicator certification for road safety to explore.

For more information

- Download the Discussion Paper

- Download the iRAP Global Business Case for Impact Investors – in English and Portuguese