Infrastructure investment projects integrating road safety into key metrics can secure faster, more reliable returns, while saving lives, says a new report by Global Infrastructure Basel Foundation (GIB), supported by the FIA Foundation.

The report, ‘Financing Infrastructure for Safe and Sustainable Mobility,’ reframes road safety as essential for ensuring a return for investors in transport infrastructure. It reveals that embedding safety into transport investment should be a financial requirement as well as a moral imperative.

Annually, 1.2 million people die on the world’s roads at a socio-economic cost of approximately 1-3% of global GDP. Commercially viable projects that deliver strengthened connectivity and safe access to public transport can, the report argues, be the best way to mobilise capital at scale, ensuring returns on investment by boosting use and reducing disruption.

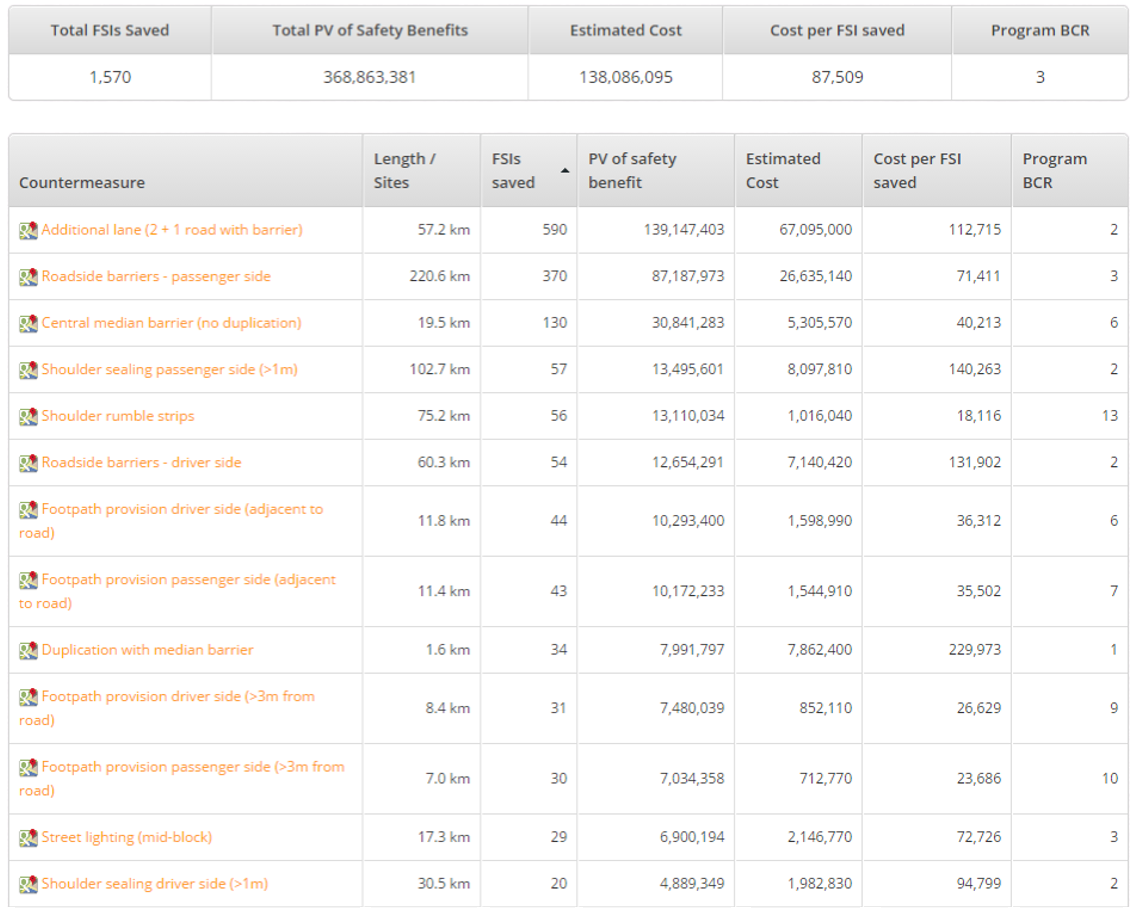

Reframing safety as a performance variable in procurement, financing, and asset management protects lives while delivering financially stable returns. The report identifies the financial value to investors, lenders, and operators and quantifies risk-adjusted returns, with case studies, models, and guidance. It includes how to integrate safety into planning, procurement, and operations for projects, including highways, urban areas, and systems like metros and bus rapid transit (BRT) systems. The research provides metrics and governance steps to track results and build confidence with funders, and highlights how to integrate safety into Environmental, Social, and Governance (ESG), or align with Climate and Sustainability Finance Agendas.

In Tianjin, China, targeted safe mobility investments around the metro increased ridership by up to 85%. Measures like protected crossings, well-lit sidewalks, cycle lanes, and integrated bus–metro–bike hubs, protecting first and last mile journeys, boosted demand. The report also models a bus rapid transport system (BRT) in West Africa. Even modest ridership increases, generated by safer and more convenient access, are predicted at up to 7% annually.

Road safety measures also improve projected internal rate of return and payback, while enhancing operations reliability, and reducing claims and disruption costs. Embedding safe connectivity and accessibility into the design and financing of sustainable transport assets deliver a triple dividend: higher and more resilient revenues, reduced operational and liability risks, and more equitable access.

Louis Downing, CEO of GIB, said: “Markets scale what they can measure and trust. By setting safety targets up front, linking finance to verified performance, and adopting transparent, comparable metrics, this report shows how road safety becomes investable – reducing crashes and claims, improving reliability, and strengthening long‑term value.”

Avi Silverman, Acting Executive Director of the FIA Foundation, said: “Everyone deserves safe journeys, no matter where in the world we live. Despite the moral imperative to protect and save lives, too often financing for safe roads is not available at the levels required. This report seeks to bridge the gap, mobilising finance for road safety by presenting the case for a compelling return on investment. Those investing in infrastructure around the world should take note, both for their own financial interests and to save lives.”

Thierry Déau, Chairman of FAST-Infra Group, Founder and CEO of Meridiam, added: “For investors and asset managers, road safety must evolve from a reputational add-on to a measurable performance variable embedded in procurement, financing, and management of the assets. When safety is internalised, it becomes a source of value: reducing accident risk, insurance exposure, litigation costs, reputational liability, and costly retrofits. It also strengthens the social license of infrastructure, an increasingly non-negotiable dimension of long-term finance.”

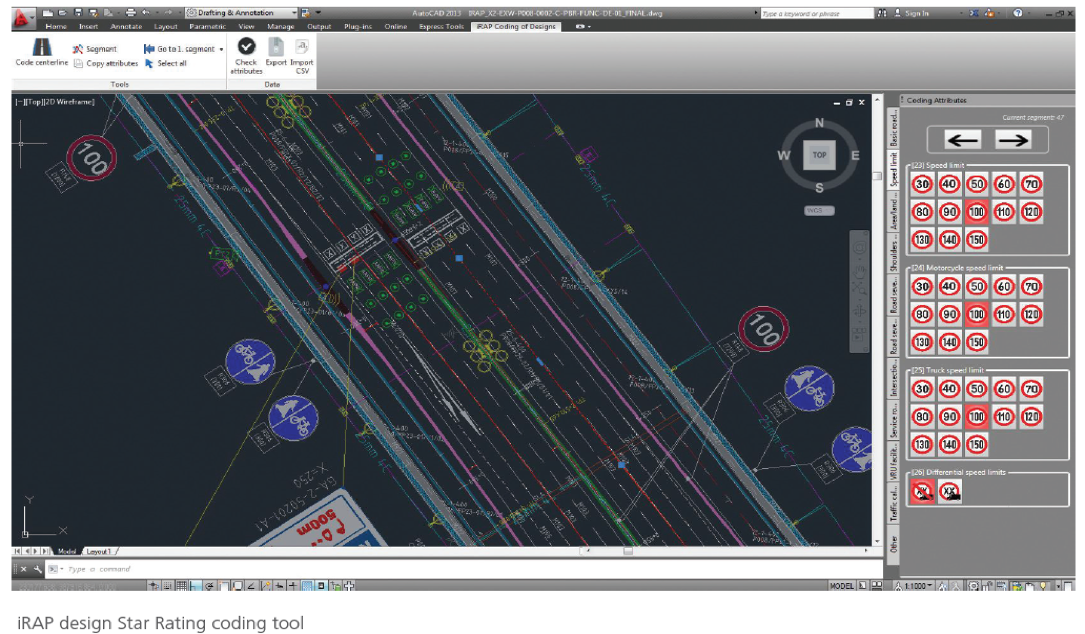

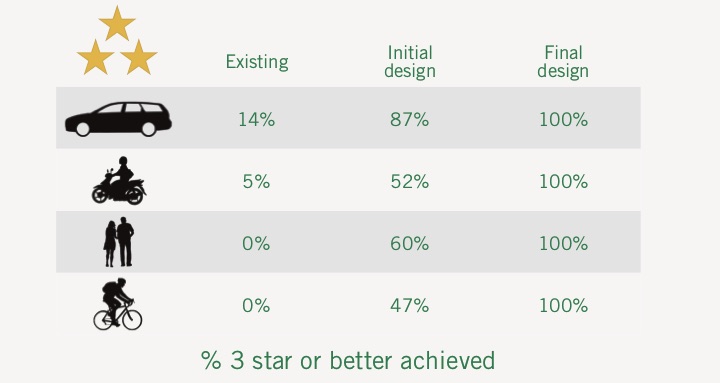

iRAP’s Chief of Future Impact Rob McInerney, who collaborated to help shape the report said, “This is one report to read cover to cover as you look for game-changing ways to scale safer and more sustainable transport systems worldwide that are win-win for all. Thierry Déau’s great quote (above) captures the spirit and practical next steps as we deliver 3-star or better journeys for all.”

At a glance: What’s inside the report

- Evidence linking safety to investment performance in both toll roads and mass transit.

- Two investment archetypes – Bus Rapid Transit (safer station access) and toll roads (reliability-first safety packages) – demonstrating positive returns of investment in safer / more accessible assets.

- Legal levers to embed safety in public-private partnerships: outcome-linked payment mechanisms, clear KPIs and independent verification.

- Innovative financing tools such as sustainability-linked instruments, outcome-based structures and securitised notes for road agencies.

- A concise call to action for asset owners, lenders, governments and insurers to standardise safety metrics and reporting.

Who should read it

- Infrastructure equity investors and lenders seeking better risk adjusted returns, impact-positive portfolios.

- Transport ministries, transport procurement agencies and municipal leaders preparing new corridors or PPP programs.

- Operators and contractors looking to streamline O&M costs by reducing incidents, claims and downtime.

Safer roads are not just a moral imperative – they are a driver for financial value.

Read the full report to explore the models, case examples and ready-to-use checklists.

Watch Global Infrastructure Basel Foundation (GIB) CEO Louis Downing and FIA Foundation Acting Executive Director Avi Silverman discuss how building road safety into infrastructure investment projects saves lives while securing faster, more reliable returns: